odd insurance question

So, apparently being a licensed, insured carpenter is not doing me any good when it comes to building my OWN home (as many on this site are, therefore I feel this could be important info to them as well).

Looking primarily for liability insurance for my property before I break ground…..I have come up empty. Builders Risk insurance only covers the materials, and it costs quite a bit of money (almost 11k yr.)

In this day and age when it is hard to even get return phone calls from trades people (I am building outside my network of colleagues), I have decided to do most of my own framing with pick up help from friends, however I am now finding that may not be a good idea if the unthinkable injury or errant nail gun mishap occurs.

The empty lot has been covered by my home state (MA) homeowners insurance up till now.

I have a small vacation home near this new home lot (NH)…..but cannot extend coverage from one place to the other.

All this planning on building…..and now this fear? This is something I think any self performing house builder needs to consider.

If anyone has advice thanks….otherwise I just think everyone should know…you are on your own should you choose to be your OWN general contractor.

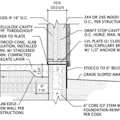

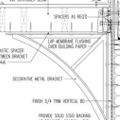

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

You need a general liability policy. You may need something customized for a construction site too. Contractor's policies shouldn't cost that much unless you're doing a LOT of buisness, since the premium is based in part on how much money you move, with the idea that the more money you're moving, the more work you're doing, and the mork work you're doing, the more potential for risk exists.

What you probably want to do is call an insurance broker that specializes in commercial policies. Those brokers will be much more familiar with this sort of thing compared with a broker that primarily does residential insurance like homeowner's policies and auto stuff. If you can't find a broker like that (and your residential agent can probably refer you to someone), try calling one of the really big commercial insurers like AIG or Hartford Boiler and ask them to refer you to an agent. I've worked with both of those companies at work before, for all kinds of specilized things (underground utility work, $10mil+ policies, etc.), and it's never been any problem.

Bill

When you are using paid labor to build a home the builder’s risk will cover the cost to put the project back to where it was before the damage.

5 years ago, was a different world but my builder’s risk policy costs $1300 thru my general contractor.

Seems like the lack of a general contractor with a history of completed projects make you look like a bad risk and the go away price tag.

I think my general contractor save me more money than I paid him. My build was done in 7 months the two houses in neighborhood without a general were still unfinished at 4 years. Both move in at 2.5 years and lived thru the construction.

I am convinced I got better pricing from the sub-contractors and suppliers because they would be working his next job. I am sure I got higher quality work on a faster timeline for the same reason.

Walta

Appreciate the advice,

Walta, like I said it is damn near impossible to get subs who do not just want easy and maximum profits (I dont blame them). When I start throwing in things like double stud walls and air sealing as you go..... they look at you like you are from mars. Most guys dont meet code minimum for insulation nevermind above code.

I get what you are saying. I have had the same discussion with insurance agent like this "why should I bother GC myself with a insurance premium like that".

I got 3 different agents (my primary agent, my business insurance agent and my vacation house agent) all working on this.....I will update if I get a resolution.

Insurance has gone up acrosss the board due to climate change disasters....I guess this justifies my posting here.

This is just one of those things I did not think of....I am sure there are more to come....ha ha

An Umbrella policy might give you the liability coverage. It's like a "catch all" policy that covers liability which isn't covered by your other policies.

True, but umbrella policies normally extend coverage from the primary policy, thus, you still need that first policy...

bill

Read the exclusions, construction is pretty commonly excluded.

If you need coverage for someone you are paying to work on your roof as an a w2 employee you need business liability plus workman’s comp coverage.

If you need coverage for someone you are paying to work on your roof as a 1099 subcontractor you need business liability plus proof of their paid workman’s comp coverage.

If you need coverage for someone you are paying cash under the table to work on your roof you are dreaming.

“When I start throwing in things like double stud walls and air sealing as you go..... they look at you like you are from mars.”

Yes, I got those looks and, in some ways, me being telling the general from the beginning that I wanted crazy stuff made it easier for the general put the crazy demands on me and allowed him roll his eyes and make sure I got what I wanted.

I still think 11K price tag is a go away and leave me alone number.

I like my umbrella policy but no way is it going to cover business or workman’s comp risks.

Walta