Earning the Zero Energy Ready Homes Tax Credit

Looking for some input on the 45L tax credit. We are intending to build a home next year that would meet the standards. However, we are intending to Owner/Build the home. We will have a local builder on an hourly consulting line, but that’s it. Are there any options to achieve the $5000 tax credit through 45L, or being owner/builders, are we not eligible?

GBA Detail Library

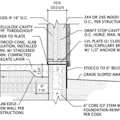

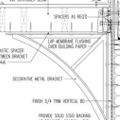

A collection of one thousand construction details organized by climate and house part

Replies

Hi Tim, the new enabling law (as well as previous versions) is ambiguous as to whether an owner-builder could qualify for the Energy Efficient Home tax credit (IRC Section 45L).

On one hand, the law refers to the property being "acquired" from an eligible contractor by a person for use as a residence. In that regard, an owner-builder wouldn't qualify since there's no transaction per se (nor would a home built by a licensed contractor for his/her own use for that matter). However, I believe this interpretation stretches the intent of the law since the purpose of the 'acquired' clause is merely to clarify which tax year the credit would apply, and that it only applies to residential property.

On the other hand, the law defines an "eligible contractor" as simply the "person who constructed the qualified new energy efficient home." Nothing says that person must be a licensed general contractor.

However, it's worth noting that the 45L tax credit is codified under Subpart D the IRC (Business Related Credits) and, as such, it flows through the form 3800 General Business Tax Credit. It would be interesting to hear a CPA's opinion as to whether this alone undermines eligibility for owner-builders. I do know some HERS Raters and Providers who have issued 45L tax credit to owner-builders under the previous version, and the definition of an eligible contractor didn't change in the new version.

The Dept of Energy is coordinating with the IRS to develop guidance on the revised Section 45L and will post a link on it's 45L page. Until and unless the IRS says otherwise, the certification of an owner-built residence is up to the HERS Rater's Provider and the owner-builder's CPA.

David Butler

Optimal Building Systems

Tim, I am in the same situation and similarly am scratching my head about why owner / builders are potentially excluded from this tax credit. After researching this, I have to disagree with David. The IRS interpretation states: "A qualified energy efficient home is not acquired from an eligible contractor if the person that constructed the home retains the home for use as a residence."

Link below. Sorry for the bad news. I'd love to hear if any owner / builders have heard otherwise.

https://www.irs.gov/irb/2008-12_IRB#NOT-2008-35:~:text=A%20qualified%20energy%20efficient%20home%20is%20not%20acquired%20from%20an%20eligible%20contractor%20if%20the%20person%20that%20constructed%20the%20home%20retains%20the%20home%20for%20use%20as%20a%20residence.

So you do not even qualify if you buy land and hire a contractor to build a home on your land, let alone be an owner builder. Unfortunate mess.

"A person constructs a qualified energy efficient home and then leases the home to the lessee or tenant." - So I build the home and "lease" it to my wife, parents, friend, whoever would allow me to use the space. In all seriousness, it sounds like it's strictly for people building and selling homes.

CONSULT A TAX PROFESSIONAL

On September 27, The IRS issued Notice 2023-65 which provides guidance on the new energy efficient home credit as amended by the Inflation Reduction Act (IRA).

https://www.irs.gov/newsroom/irs-builders-of-qualified-new-energy-efficient-homes-may-qualify-for-an-expanded-tax-credit-under-section-45l

For reasons unknown, I never receive email notifications for discussions I subscribe to so I'm just now seeing the October comments.

I somehow missed the 2008 guidance posted by Mark. It does seem to preclude owner-builders and even actual contractors who build their own residence.

@Armando, thanks for posting a link to the new Section 45L guidance document (applies to homes built after 12/31/22).