2005 EPAct Tax Credit, Energy Efficient Home Credit

My question concerns new home construction, which allows a contractor or builder a $2,000 tax credit if he or she qualifies. My question is: when it was renewed by congress earlier this year, it was extended to cover “qualified new energy efficient homes sold or leased in 2012 and 2013”. What is the definition of “sold”? If it refers to the actual closing, builders will already be running out of time to qualify for this, for it takes several months to complete a new home. If a builder starts a home now, but it’s not completed until January of 2014, does he miss out on the tax credit?

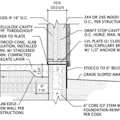

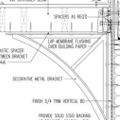

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

Mark,

I don't see much wiggle room in the language. As things now stand, this tax credit will expire at the end of the year. For a contractor to claim the tax credit, the new home must be "acquired by sale or lease by an individual from that contractor during the tax year." As far as I know, the sale occurs at the closing.

According to the relevant page on the DSIRE website, "The home qualifies for the credit if ... it is acquired from the eligible contractor after December 31, 2005, and before January 1, 2010, for use as a residence."

I agree with Martin on lack of wiggle room. My firm specializes in these incentives. The rules provide:

[A] qualified energy efficient home is acquired from an eligible contractor in the following situations:

(1) A person constructs a qualified energy efficient home and then sells the home to the homeowner.

(2) A person constructs a qualified energy efficient home and then leases the home to the lessee or tenant.

(3) A person hires a third party contractor to construct a qualified energy efficient home and then sells the home to the homeowner.

Unfortunately, it doesn't have "available for sale or lease" language. Part of the reason these incentives and so many others expire is due to Federal budgeting purposes. A tax incentive is viewed as a liability, and if it is set to continue indefinitely, it will makes the liability bigger for budgetary purposes. Thus, they are often limited to only one year. I fully expect this incentive to be renewed, as it has been since 2006.

Alex Bagne

TaxAnalyticsGroup.com