Image Credit: Hidesert on flickr.com

If you’re buying a green home or investing in energy efficiency improvements for your existing home, calculating the simple payback for your investment is at best incomplete and at worst, completely irrelevant. Before I get to the reasons why payback isn’t the right way to look at home energy efficiency improvements, let’s define simple payback.

Let’s say you buy a new refrigerator to replace that old energy hog from the ’80s you’ve kept way too long. I did this a few years ago, and the old fridge was using 150 kilowatt-hours (kWh) per month (as measured with my WattsUp Pro). The new fridge uses only 40 kWh per month. At $0.10 per kWh, this change led to savings of (110 kWh / month) x ($0.10 / kWh) = $11 per month, or $132 per year.

To calculate a simple payback time in years, you plug the numbers into this equation:

Simple Payback = Total Cost ÷ Annual Savings

When you run the numbers for this fridge, whose cost was $800, you find that the simple payback is just a bit more than 6 years.

Strike 1 against simple payback

Right away, you may see one problem with using simple payback in this example. If you’ve got to replace your fridge anyway, using the total cost here would be the wrong number. If you made a choice between an efficient model and a less expensive inefficient refrigerator, then the difference in cost is what you should use. For example, if the more efficient model cost $132 extra and saved $132 per year, the payback on the extra efficiency is one year.

Strike 2 against simple payback

What’s the payback on the granite countertops in the kitchen? What’s the payback on those hardwood floors? And, most important of all, how long will it take for that beer-launching refrigerator to pay for itself? (You’ll have to watch the video to find Dave Letterman’s answer to that last question.)

The point here is that payback measures only cost effectiveness, but if the investment has other benefits as well, payback is an incomplete picture of the value of your investment. When you invest in a high performance home, energy efficiency is only one of the benefits. You also get comfort, healthfulness, and durability.

Strike 3 against simple payback

The final strike against payback is that it’s completely irrelevant if the investment is financed over time. How can you pay yourself back for something you haven’t completely paid for? You can’t!

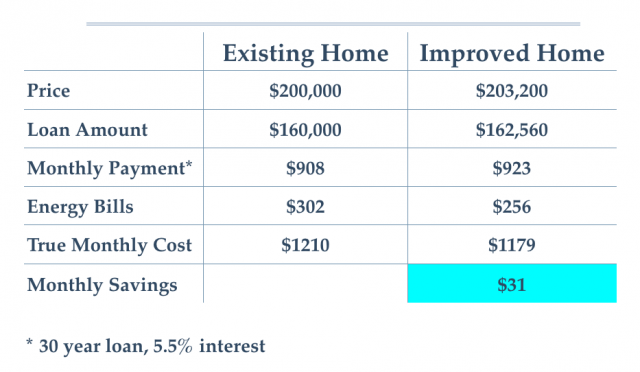

In this case, the relevant measure is cash flow. Here’s an example:

As you can see, it makes complete sense to buy what looks like the more expensive house because that extra $3200 pays for itself in the first month.

If I’m trying to get you to buy the more energy efficient home, I’ll offer you this deal: You can buy it for exactly the same monthly payment as the other house would cost ($908) except I’m going to come to you and ask for another $15 each month (extra mortgage payment) and then I’ll give you $46 (energy savings). You end up with an extra $31 in your pocket each month!

So, let’s get over this obsession with payback. If you’re paying cash for something whose only purpose is to generate savings and has no other benefits, then simple payback is relevant. In other situations, it’s best just to forget all about payback.

Allison Bailes of Decatur, Georgia, is a speaker, writer, energy consultant, RESNET-certified trainer, and the author of the Energy Vanguard Blog. You can follow him on Twitter at @EnergyVanguard.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

17 Comments

Figures don't add up

The home cost an additional 3200 but your mortgage only increased by 2560?

What did you do? Twist the arm of the builder for a discount?

Aaron: The mortgage amount in

Aaron: The mortgage amount in both cases is 80% of the home price. It is assuming a 20% down payment.

Amen!

Allison:

Thank you for posting a blog about this. I've been pointing out the flaws of simple payback for years, even before I started Green Builder Coalition. I've spoken at RESNET about it, and most recently used it two days ago in the 2015 IECC-R code hearings. Simple payback mentality also assumes energy prices will remain stable.

Few people buy a house like they buy a loaf of bread. Total cost of homeownership is where it's at. That's why the SAVE Act is so critical to homebuyers looking to purchase green homes.

And your sentiment pertains to measures that can save money on your insurance premiums or, to a lesser extent, water bill. It's not just confined to energy.

If I could, let me offer up this equation on cash flow:

Added monthly expense:

Cost of upgrade / 360 = X

(X * 12) * Int. rate = Y

Y / 12 = Z (True monthly expense)

Estimated monthly energy savings = E

Z – E = +/– cash flow

Nice job, Allison

This is one of the clearest and most entertaining cases against simple payback I've seen since I first heard of the term. Thanks!

Thanks Allison!

Nicely done, again.

"If you're paying cash for something whose only purpose is to generate savings and has no other benefits, then simple payback is relevant."

Mmmmm. Maybe not even then. Mind if I expand with personal perspective?

It's been my experience that people rushing to perform simple payback analysis are pretty unsophisticated. So they typically assume no residual value of the whole or the increment. Forgetting to consider if the thing once bought provides incremental value say, at sale of the home means their math is wrong.

For example, from a capital perspective if the thing does not depreciate at all, isn't the payback instantaneous?

Some EE improvements purchased for savings alone may not fully and immediately depreciate to $0 residual. Residual value must be considered in simple payback analysis, and this should be pointed out to those who myopically focus on "Payback" because concepts that are simple to you may not be simple to them.

Great Article

I've seen some people state that going from R-40 to R-60 in the attic was an additional $1,000 but the payback time was 28-30 years, so they chose not to add the insulation. I would find these energy vs payback justifications to be completely flawed. I am glad this article brought this to light. One thing is certain, energy costs will up, and electrical rates will increase. That is certain.

To borrow the article reference about granite tops: when someone buys granite counter tops for the kitchen and the bathrooms for $20k but then skimps out on insulating the home beyond code minimum, what is the ROI for those granite tops? Yet, for the next 50+ years the home will be an energy hog operating at code minimum (usually 2006 codes).

I was discussing with someone about getting better windows on their new home build. They would argue that they don't want to spend the money on energy efficient windows, as it does not add value to their home when it comes to selling it later on. That is the mindset of some people. What surprised the home builder was that when he priced out his double pane U-Value 0.35 big box store windows, the homeowner could get triple pane U-Value 0.17 windows like Intus uPVC for a few dollars more than what he was going to pay for the double pane windows. In addition the sliders and double hung windows he was going to get leaked a lot of air. While the European triple pane tilt & turn operable get < 0.03 cfm/ft². The sad part is that when the builder tells them that adding better windows or adding more attic insulation for $1,000 is not worth it because the "payback" is 30 years, this feeds into the flawed payback concept.

Response to Peter L

While I am on your side, I wouldn't want to give people the impression there is no payback for granite countertops. If the homeowner goes with formica instead of granite, there is probably a negative effect on their resale value. Countertops don't have an "operational ROI" (if there is such a term) like energy efficient products do.

Said another way, countertops can have 1 ROI (resale). Energy efficiency has 2 ROIs (lower operating costs and resale).

P.S. I need more people like the respondents on here at energy code hearings. You'd be amazed how often the flawed logic of simple payback was used by NAHB this past week to fight energy efficiency.

Selling Payback

When it comes to selling a home buyer on energy efficiency enhancement, payback is the usually the first issue that enters their mind. Based on that calculation alone, the enhancements are often deemed to be not worth the investment. In the example of paying an additional $1000 for insulation that pays back in 28-30 years, the buyer may not have the extra $1000, or they may not think they will own the home for the time required to pay the money back.

One could argue that the payback of the extra $1000 will continue for the next buyer if the house is sold before it pays back the original investor; and therefore, the original investor will get the unearned balance of his $1000 investment in an enhanced selling price. So, overall, the $1000 gets paid back to the original investor no matter how short his span of owning the house.

The problem with that reasoning, however, is the uncertainty of the housing market. Housing used to be an infallible investment, but that confidence has been dashed with the experience of the last 6-8 years. Many people have suddenly lost as much as half their home equity for reasons that few can understand or even explain. So housing is no longer a trusted investment and will likely never regain that trust. This means that the recovery of the cost of extra upfront enhancements in a resale price is quite dubious.

There is another problem with selling the idea of simple payback. That is the pushback of the building industry. Even if a homebuyer can be convinced that the extra $1000 investment has an acceptable payback, the builder may tell the customer that payback will not happen or not be worth it. This seems to be based on builders believing that they will lose money on any departure from the average approach to building, even though the customer is willing to pay for the justifiable cost increase for the enhancement. In my opinion, on average, this industry resistance is greater than that of the homebuyers. And moreover, the industry skepticism will easily influence a homebuyer as he or she naturally defers to the builder as being the expert.

Absent from the financial analyisis sketch...

is the fact that the interest portion of the increase mortgage payment is subsidised by current US income tax code via deductions, (the value of which will vary by your income tax bracket) , whereas the payments for the utilities are in after-tax dollars. A dollar increase in mortgage payment is actually less than a dollar from an after tax cash point of view, whereas a dollar decrease in utility costs is truly in fully-taxed savings.

Early in a mortgage nearly all of the payment is tax deductible. Under recent underwriting rules it would be nearly impossible to qualify for a $160K without being in at least the 28% tax bracket, which means that $15 bump in mortgage payment is really more like a $11 bump, less if you're in a higher tax bracket. (Yes it's better deal for the already-well-off.) That makes the monthly net-reduction $35,or greater, not $31.

Looking simply at the raw monthly payments misses the tax aspects, underestimating the true early years' savings by a double-digit percentage.

Most home buyers have never heard of a net-present-value financial analysis let alone performed one. By some economists' analysis' if one used purchasing behavior to calculate the applied discount rate people tend to use for energy related expenditures it's well into double digits, sometimes as high as a whopping 50-60%, (a dismal state of affairs indeed!) but utilities and other investors can make more reasonable decisions based on the math. The fact that the lifecycle per kwh cost of photovoltaic solar is already BELOW the residential retail rate (even without subsidy), when subsidies are applied there's a pretty fat margin to be made by third party PV owners cutting power purchase agreements with both the homeowners and the utilities, effectively "renting" the rooftop space for permission to put the hardware up there. See: http://blog.rmi.org/blog_2013_08_21_want_solar_on_my_roof_pay_me_for_it

What about retrofits?

I am definitely hung on payback for my house in NY. We bought a 2200sqft home built in 1960. We paid $180k for it 2 years ago and I doubt the value has changed much since. The house has ok vinyl siding, newer asphalt roof, vinyl kitchen floor, and laminate countertops. The home inspector loved our natural gas boiler. We use about 1200 therms of gas per year.

One issue I did not pay attention to was original single pane windows. They were not in great shape. They are very drafty and some sills have deteriorated. I would love to go with triple pane tilt/turn windows. In researching windows, I found lots of other information here and read up on deep energy retrofits. Since I'm planning to replace the windows, what else should I do at the same time? How about tightening up the envelope and adding 3-4" of exterior insulation? Well, that means I have to replace perfectly good siding. I have no overhang on the gable ends so the perfectly good roof needs messed with too. So I'm talking maybe $75K-$100K of work. What do you think the house would be worth after that? Would a bank finance it? What if I have to sell in 6 months? On the other hand, maybe I just do windows and add nice tile and countertops in the kitchen. That would cost me a heck of lot less now, be slightly more energy efficient, my house will be worth more, and easier to sell. That is not the answer I really want but I think it is true.

Response to Daniel Blass

Daniel,

You're quite correct, of course, that if you invest $75,000 or $100,000 in a deep-energy retrofit, you would never recover the investment if you sold the house. Those who disregard payback calculations need to admit as much.

Here's some advice: the most cost-effective measure for improving your single-glazed windows is to install low-e storm windows. Assuming that your existing windows can be repaired -- even rotting sills can be repaired with epoxy or by replacing the sill with new wood -- and the weatherstripping can be improved, single-glazed windows with low-e storms can perform very well.

Single pane solutions

Martin has it right- rare is the case that replacement windows are the next-most-cost-effective upgrade to a 50 year old home. (Some aluminum framed circa 1960s windows are worth scrapping though.)

If the circa 1960 single panes are wood sash and can be tightened up with bit of weatherstripping work, fixing the windows and adding a tight/very-tight low-E hard-coat STORM window results in a U-factor comparable to a code-min replacement window at a fraction of labor & cost of a replacement window, and would "pay back" on fuel cost savings in well under 10 years even at condensing efficiency and current near-record low natural gas pricing. Harvey has the tightest storm windows in the biz, and have a hard coat low-E option, but the Larson low-E storms sold through the box store chains don't suck if you pay the upcharge for the Silver or Gold series. (The low end Bronze series still leak a lot of air.).

With the difference in cost you can then do some blower door directed air sealing & infra-red imaging directed spot-insulation which is also going to be pretty cost effective at least on the first round.

Most homes built in 1960 have ZERO foundation insulation, and insulating & air sealing basement foundations is typically results in heating fuel use percentage reductions well into double-digits.

Two omissions from my scenario...

Thanks to Dana Dorsett for catching my omission of the benefits of deducting the mortgage interest. That indeed makes the cash flow calculation more favorable. I heard from Michael Blasnik yesterday that in the scenario I presented above, I also ignored the effect of the extra down payment, which he says will make it take almost two years to get you to the breakeven point.

Dana came up with a benefit of about $4 per month for deducting the mortgage interest. I just ran the mortgage calculator for $163,200, the full amount of the home with the improvements in my scenario above, and found that the new mortgage payment is a bit less than $4 higher. So those two effects cancel each other out, and my numbers still work.

By the way, if you're wondering about not paying an extra down payment amount on $3200 of improvements here, that's one of the features you get with an Energy Efficient Mortgage (EEM).

A few tweaks to make it better

This is a g good conceptual discussion, but a few tweaks should be made to yield the proverbial apples-to-apples comparison. First, ignore the effects of the down payment. Cash that is otherwise invested in a house has a cost, even if it is not explicit (e.g., you could invest the difference). You can spin down a rat hole on alternate investment strategies, so your simplest way of giving a reasonable comparison is to assume that all alternatives are 100% financed. This is also the reason to ignore the effects of the mortgage interest deduction. The value of this deduction varies based upon the individual homeowner's circumstances and is only relevant in comparison to the alternative uses for the cash (another instrument might have similar deductibility).

Second, different lenders will look at various upgrades differently, so there may be a rate differential ("spread") between various options (e.g., a GSHP may require special financing while upgrading +5 SEER on an ASHP may be just fine with a conventional lender). A corollary to this is that some upgrades will come with rebates or other incentive payments. Lenders may disqualify these upgrades if the homeowner gets too much money back for the purchase, or they may require the homeowner to include any rebates as part of the down payment (back to why you should not include the down payment). For example, a $30k PV system with a 30% federal tax credit might only be financed at 80% of the $21k after-credit 'cost', if you can get a loan at all.

Finally, all of the above assumes that you can get good numbers either on acquisition/installation costs or on operating costs. For the home we are building, this last piece has been particularly problematic. As a result, it's required me to engage in some sensitivity analyses - basically adjusting some assumptions to see how the modeled cash flows respond.

Cost is relevant

When purchasing a green home, cost is... Relevant. Otherwise nice blog.

On the plus side (of replacing windows)

... there is a 30% federal tax credit on the purchase of energy efficient windows that expires at the end of the year. So that should factor into your financial calculations of now versus later (in addition to the energy savings).

Great Article

Thanks for this insightful piece. So much time is wasted debating the value of green/sustainable options based on incomplete data or irrelevant factors. A colleague recently summarized the issue nicely, pointing to a project where the monthly savings from efficiency upgrades exceeded the monthly payments on the loan required to make them - that's money in your pocket.

Log in or create an account to post a comment.

Sign up Log in