Image Credit: U.S. Department of Energy

Congress last month extended valuable tax credits to producers of electricity from wind turbines and purchasers of solar equipment, a move that came as a relief to an industry that has experienced rapid growth in recent years.

A tax credit for wind power producers had lapsed almost a year ago, and the credit for solar power was scheduled to decline sharply at the end of 2016. Now, renewable electricity generators have several years of unprecedented stability: the renewed wind and solar power credits don’t expire until 2020 and 2022, respectively.

The extensions were finalized just days after 196 countries agreed to reduce their greenhouse gas (GHG) emissions as part of a global effort to mitigate climate change. The White House hailed the extensions as an important step toward this goal.

Recent studies, however, indicate that tax credits are not the most effective means of achieving reductions in greenhouse gas emissions. A closer look at this tax credit policy not only shows its flaws but also sheds light on how to best promote the spread of renewable energy and lower carbon emissions.

Good news for solar and wind

Tax credits have played an important role in promoting the construction of new wind and solar power capacity in the U.S. Owners of photovoltaic (PV) systems receive a 30% tax credit on the cost of a system, while wind power generators have received as much as $23 for every megawatt-hour of energy produced.

A 2014 study by the National Renewable Energy Laboratory found that maintaining the credit for wind power through 2020 would lead to 10 gigawatts per year of additional capacity constructed. That’s roughly the same generating capacity as 10 full-size nuclear power plants, although wind turbines produce power only about a third of the time.

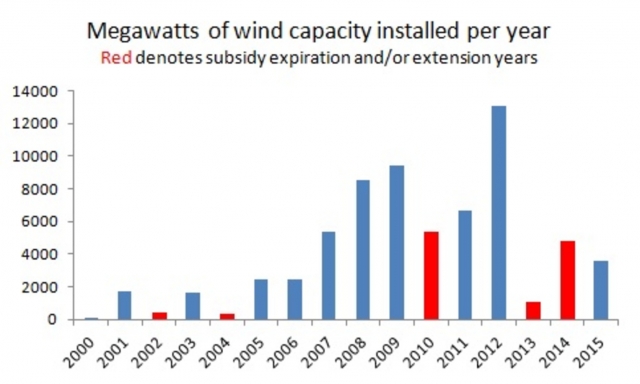

In the past, the tax credit for wind had been allowed to expire for short periods before renewal, and new construction fell sharply during each of these periods.

Similarly, if the solar tax credit had expired, PV installations were expected to experience much slower growth in the years ahead. The Energy Information Agency projected residential solar power’s annual growth of 30% from 2013 to 2016 to slow to only 6%.

If solar power is to displace a significant share of fossil fuels for power generation, then it needs to have much higher growth. In 2014, solar power accounted for less than half of one percent of all electricity generation in the U.S., even after several years of rapid expansion.

Is there another way?

The tax credits for wind and solar power are different from many U.S. renewable energy subsidies in that their value is not determined by the amount of GHG emissions displaced by new installations.

The U.S. Renewable Fuel Standard and California’s Low Carbon Fuel Standard both provide financial incentives to produce renewable transportation fuels. Only those renewable fuels that achieve substantially lower greenhouse gas emissions than the fuels that they are displacing qualify, however.

Proponents of the solar and wind credits note that both are “zero emission” in that they generate electricity without emitting climate-changing gases. The amount of GHG emissions displaced, however, depends on which fossil fuels are displaced. This, in turn, varies widely by state.

Wyoming’s coal mines, for example, produced 39% of the coal mined in the country in 2013, while 88% of the electricity generated in the state in 2014 came from coal. Coal is one of the largest fossil sources of GHG emissions. Wyoming’s electric sector is thus one of the country’s most polluting in terms of its emissions of carbon dioxide and other GHGs.

At the opposite end of the spectrum is New York. That state derives 48% of its electricity from zero emission sources, notably hydropower and nuclear energy, and another 48% from relatively low-emission natural gas. A gigawatt of wind capacity installed in Wyoming therefore displaces more GHG emissions than in New York.

The contrast between Wyoming and New York shows how the renewed tax credits for wind and solar power are not as effective at reducing GHG emissions as they could be. This is because the credits subsidize both energy sources equally regardless of whether the installations are displacing highly polluting fossil fuels or zero-emission renewables.

Displacing coal or hydro?

Further reducing tax credits’ effectiveness is the fact that fossil fuels remain cheaper sources of electricity than many renewables. This is true even when renewable energy receives subsidies.

Wind and solar power are most competitive in those markets with the highest electricity prices. That’s why New York has almost 1,400 times more installed solar power than Wyoming, because its electricity prices are the higher of the two.

The tax credits reinforce this disconnect between environmental benefits and installation locations by ignoring displaced GHG emissions. Yet where renewable energy is installed in the U.S. has profound implications.

A 2013 analysis published in the Proceedings of the National Academy of Sciences looked at the benefits of U.S. wind and solar power installations in multiple locations. It identified a range in the combined environmental and health benefits of $10 to $100 per megawatt-hour depending on where they were installed. The authors concluded that one megawatt-hour of wind energy produced in coal-rich Ohio yields five times the combined benefits of the same energy produced in New Mexico.

A study published this month in Nature Climate Change reached a similar conclusion. It valued the combined benefit range of U.S. renewable energy and energy efficiency projects at $14 to $170 per megawatt-hour depending on location.

Without a doubt, the extensions of the tax credits for wind and solar power will cause renewables’ share of the U.S. electricity market to displace that of fossil fuels at a much faster rate than would have otherwise been the case.

However, a growing body of research suggests that the ability of the tax credits to slow climate change would have been still greater had the value of the subsidies been instead linked to the amount of GHG emissions displaced by installing renewable energy.

Tristan Brown is an assistant professor of energy resource economics at the State University of New York’s College of Environmental Science and Forestry. This post originally appeared at The Conversation.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

18 Comments

Try the per capita comparison instead- you're spinning too hard!

"Wind and solar power are most competitive in those markets with the highest electricity prices. That’s why New York has almost 1,400 times more installed solar power than Wyoming, because its electricity prices are the higher of the two."

Comparing raw numbers between two states of widely differing population sizes exaggerates the number- it's a cheap trick, a misrepresentation. New York has about 33-34 times the population of Wyoming. So rather than 1400x the total installed solar, try ~40x the amount of solar PER CAPITA. While that is still a large multiplier, is a more relevant comparison.

Also, care to look up which state burns more coal, in raw numbers? (I haven't yet, but my bet is on NY.) The notion that new wind in NY is displacing only hydro power is not a proven thesis. If you were really looking for the other end of the spectrum you'd look at Washington, not NY, where almost ALL of the grid power is hydro, and there is almost no coal burning going on. Show us the data that indicates new wind in NY is displacing hydro rather than coal.

And, the difference in electricity prices is only part of the driver, an overly simplistic explanation. Politically renewables are very popular in NY and the state provides substantial incentives. Politically in WY the coal mining industry is a major employer and source of tax revenue for the state, and treated with kid gloves.

Coal consumption in New York state

According to a December 2009 document titled Coal Assessment: New York State Energy Plan 2009, "In 2007, New York used 253 trillion British thermal units (TBtu) of coal, which represents 6.1 percent of the State’s total primary energy use and 13 percent of its electricity generation."

New York vs. Wyoming

According to a published table titled U.S. Coal Consumption by End Use Sector, Census Division, and State, 2013 and 2012, here are the coal consumption figures for 2013:

New York state: 3,041,000 short tons

Wyoming: 29,531,000 short tons

Wyoming wins.

Ditching the tax credits will

Ditching the tax credits will encourage more production in the dirtiest states? Maybe my coffee this morning has not kicked in, but natural gas still produces a great deal of CO2, just relatively less than coal. For starters i would start by removing subsidies from fossil fuels, they are subsidizing a massively profitable enterprise and are obsolete for decades now, but putting that aside, i can agree with extra targeted subsidies for the dirtiest states but we should remember that states import and export power to their neighbours, and hydroelectric is often baseload AND adjustable, for example Niagara Falls and other hydropower sources can reduce, increase or some even pump water for extra or reduced generating ability when needed, which COMPLIMENTS solar and wind.

If our goal is stopping climate change then no amount of natural gas is acceptable, because without CCS it still produces CO2, as does any fossil fuel. Electric automobiles will also allow grid stabilization (and reduce another mobile CO2 source), a smart grid can use them to accept extra power and even deliver it as needed. Grid storage will also compliment renewables. The common theme here is that in the US we need more, not less renewables, so ditching the tax credits is either shooting ourselves in the feet, or astroturfing (which is ultimately the same thing).

Tax credits distort market pricing.

Tax credits for renewables trades one form of crony capitalism (ie. rent-seeking) for another. The fact that one agrees with the credit doesn't make it any less disruptive. Some better ways: #1 Do away with all tax credits in general (Fossil, ethanol, solar, wind, EV, etc) instead of playing favorites at the taxpayer expense. #2 Decentralize power generation.

While it's true the fossil fuel (Oil) receives tax credits the overwhelming bulk of these credits revolve around agriculture (Farms don't pay sales tax for diesel fuel used in agriculture), the Strategic Oil Reserve, and fuel for low income households.

Why is market pricing a

Why is market pricing a god?

Our goal is prosperity and safety for all, laws that promote this are good for people and the environment. Subsidizing oil is bad for obvious reasons, subsidizing the transition to post oil is good. The market is not sacrosanct, its a tool to promote commerce and prosperity and an imperfect one.

Guess I lost the coal bet...

... lost it by an order of magnitude even!

The incentives for solar in heavy-hydro Washington state are much higher than those in Wyoming, and it wouldn't surprise me if the PV-watts per-capita in WA is much higher than in WY too. Lets see...

According to NREL data there are 2.05 MW of solar installed in WA, 0.21 MW installed in WY. By Tristan Brown's descriptive method one might conclude, "Wow! Washington has TEN TIMES the amount of solar as Wyoming- must be the price of electricity driving that!".

However, WA has a population of 7,061,530, WY a population of 584,153. So the watts per capita are:

WY: 0.21MW /584,153= 0.36 watts per capita

WA: 2.05 MW/ 7,061,530= 0.29 watts per capita

Wyoming has a ~20% more solar-rich grid than Washington- that must mean WY is greener, right? No, wait it means their power is 20% more expensive... or maybe price isn't the defining factor:

Retail electricity pricing in those states are comparable. As of 2013 WA pricing was about 7 cents, WY it's about 7.2 cents. More recent data show modest increases in pricing in both states, but still about the same spread.

http://www.eia.gov/electricity/state/

http://www.neo.ne.gov/statshtml/204.htm

https://openpv.nrel.gov/rankings

https://simple.wikipedia.org/wiki/List_of_U.S._states_by_population

Clearly despite comparable electricity cost and sort of similar PV per capita penetration, the PV in Wyoming is doing a LOT more good than PV in Washington, and that's a much clearer and simpler case to make than NY vs. WY, which is really all over the place, and a case that hasn't been credibly made with the evidence in this blog piece. Where is the evidence that new-renewables in NY are predominantly displacing hydro rather than displacing fossil-fuels?

"At the opposite end of the spectrum is New York. That state derives 48% of its electricity from zero emission sources, notably hydropower and nuclear energy, and another 48% from relatively low-emission natural gas. A gigawatt of wind capacity installed in Wyoming therefore displaces more GHG emissions than in New York."

NY isn't at the opposite end of the spectrum, it's in the middle. And while it's an interesting thesis, the conclusion doesn't follow. Just because WY is nearly all coal and NY is ~50% carbon-free doesn't mean that when new wind goes up it displaces both the high-carb and zero-carb fractions proportionally. Despite the higher thermal efficiency of combined cycle natural gas, it's been widely documented that at the current rate of methane emissions from NY & PA's natural gas production sources, the global warming potential of all of this "low-emission natural gas", is not very different from thermal coal when the methane is accounted for. Until the shale gas methane emissions are corrected the celebration is a bit premature. Only when skewing it to carbon-only accounting is natural gas lower impact on the climate change front (though it's much cleaner from a local air pollution point of view.)

The marginal cost per MWH of anything that has a fuel cost component is more likely to be displaced than generation that has near-zero marginal cost, so it's likely that new wind in NY displaces more natural gas than hydro. It may be slightly more beneficial to the planet to put that wind in WY than NY, but it's not likely to be nearly as high as the average grid mix numbers might imply, or the simple carbon "ignore the methane, no story here" greenhouse gas accounting. This still feels like too much spin, not enough nuance and incomplete evidence regarding states that still have a sizable fraction of fossil-fired generation, which would be most US states.

There's also the factor that the US grid regions do not align with or reside completely within the state boundaries (with the notable exception of the ERCOT / Texas grid.) Vermont currently has no fossil fired generation within it's state boundaries, but a gigawatt of wind in Vermont would very definitely displace gas and coal fired generation within the ISO-NE grid operating region, and Vermont also imports power from a variety of high-carb and no-carb sources within both the ISO-NE and the greater regional grid.

I'm not saying that Tristan Brown doesn't have a point, but that he's making it poorly, with apparent thumbs on the scale.

Creating a mature industry

My understanding of the primary goal of the renewable subsidy was to help accelerate the development of mature wind and solar industries. Any new industry has a chicken-and-egg problem. Low volumes cause prices to be higher and higher prices cause volumes to be lower. A subsidy helps by lowering prices to consumers which increases volume in the hope that the increased volume will lower prices. The PV industry is an excellent example of that happening successfully with the subsidy in place. (We have to guess at how rapidly it would have been happening without the subsidy.)

When PV and wind were a tiny fraction of the generation, they didn't make a substantial difference to GHG production no matter where they were deployed. The first step was/is to develop mature industries in at least some locations. Those locations will be the ones with favorable combinations of high electric prices, good solar resources, and little political resistance. Focusing resources in Wyoming would probably not be very effective at that stage. After a mature industry is in place in some locations, then we need to get them to expand into the areas where they help the most. There is a legitimate argument about whether now is the time to start making that transition. Given the fact that PV prices are still on a rapid downward trajectory, I would argue that it is not time for that yet. The wind industry seems to be more mature than the PV industry although I don't have data to back that up.

@Alan

The real question is why do we ask The State to use force to enforce politically favored ideas?

Should people living in Ohio subsidize hurricane insurance for coastal homeowners in Florida simply because "one day they will retire there"? Of course not. So why should people in Ohio be forced to subsidize the cost of PV's for those living in Florida?

All I'm saying is that it's possible to have less expensive PV's if subsidies for all forms of power generation were removed.

Response to Chris M

Chris,

Q. "Why do we ask The State to use force to enforce politically favored ideas?"

A. All I can say is, it sure beats using force to enforce ideas that aren't favored.

Jobs and economics

I wonder if anyone has looked at the job creation and economic impact of the solar industry at the national and local levels. The employment rate in the solar industry is over 20% per year in the last five years, creating close to 1.5% of all jobs in the US, and by far, it created more jobs than any other energy generating sector. As an example, the average wage for installers, sales, production and design is well over $30 per hour, way above the average wage in many of the construction sectors. A UMass research calculated that for every $1,000,000 investment in solar industry, created 15 jobs, which is far above than the gas and coal industries combined.

Besides of solar power helping slow global warming, it’s saving society billions of dollars the projected cost to mitigate solar warming. Some statistics point to savings average over $1,000 per year in energy bill for homes with PV systems. Solar energy provides some degree of energy independence, reliability and security.

The better part of the argument is that the sun is not going away for a while, so the industry in not going to be in a glut, as I suspect, it will have a large impact in our economy for a long time. The ITC is only facilitating and assuring the economic recovery continues, even if at a slow pace.

Response to Chris M

Q. The real question is why do we ask The State to use force to enforce politically favored ideas?

A. That is the reason for having a state. Favored ideas like private property rights, not murdering, raping, or enslaving one other, etc. need some form of enforcement. Having the state use force is more effective than the alternatives.

There is a proposition in economic theory that says, on economic issues, markets always produce an optimal result. The proof of that theory defines optimal as maximum GPD and makes assumptions like perfect information, no barriers to entry, all cost reflected in the prices, etc. When these assumptions are relaxed or optimality criteria changed, there are circumstances in which the proposition does not hold. In some circumstances, it is reasonable to believe that we can make a better collective decision using a political process than by relying on a market. Of course, political processes are not infallible either.

@Chris M

"The real question is why do we ask The State to use force to enforce politically favored ideas?"

We should use the state to benefit humanity, using it to deny healthcare to women, punish the poor, take from the poor and the rest of society to give to the rich, legalize discrimination, deny reality, impose religious "ideals" on civilization (slavery is acceptable in the bible you know) and allowing corporations to murder for profit do not benefit humanity, yet its whats being done and is proposed to be expanded by a party that sells itself as benefiting humanity and is widely accepted as fact.

"Should people living in Ohio subsidize hurricane insurance for coastal homeowners in Florida simply because "one day they will retire there"? Of course not. So why should people in Ohio be forced to subsidize the cost of PV's for those living in Florida?"

The tax credits are available to all who wish to use them, they do not discriminate, and don't forget fossil fuels have costs, they have fuel costs, environmental costs, health costs, human life lost costs, weather costs.

100 year storms happening several times a decade, air pollution, water pollution, earthquakes, food shortages and toxicity, flooding and a whole host of other costs are borne by the public while profits are privatized. Apparently this is acceptable, but saving and improving everyone else's lives is asking too much. Would you tell your children, spouse or family members i won't help you because your ill and i never had XYZ condition when i was your age, so no time off school or work, no hospital or medication for you? I hope not.

When Ohio has a snowstorm that cuts power or causes flooding, or the lake catches fire again, don't expect the national guard or any other American even from other parts of Ohio or even your next door neighbour to assist you. Thats what your arguing for.

Its even more ironic that by preventing disastrous climate change everyone benefits, some more then others but no one loses by having a safe place to live

"All I'm saying is that it's possible to have less expensive PV's if subsidies for all forms of power generation were removed."

Are you insane, prices don't magically drop because subsidies are taken away, or else solar would cost peanuts the day after it was invented. R&D, manufacturing facilities, materials, supply chains and new technology all cost money to develop. The free market being perfect is a fallacy, or one might even call it a religion, if you believe "god" will save you, if you suffer its because you did not believe strongly enough. As if.

100% green electric grid by 2050

Thankful we are headed towards a 100% green electric grid by 2050. Once O'Malley wins the election in 2016 he will see to it that it gets built. I'am sleeping better just knowing it is on the way.

@Alan

In the words of Frédéric Bastiat "I do not dispute their right to invent social combinations, to advertise them, to advocate them, and to try them upon themselves, at their own expense and risk. But I do dispute their right to impose these plans upon us by law – by force – and to compel us to pay for them with our taxes".

@ Chris

First: You've already lost that battle, unless you can convince oil companies, coal companies, natural gas companies, and tax evaders to repay all that they owe. Let us know when this is done ;)

Please get us back the corporate welfare and preferential tax treatment given as well

Second: Its funny that progress is bad, especailly when one is driving off a cliff and denying it or choosing to drive even faster towards it becasue their gods command them to

@Alan

Don't get me wrong. I've always been an advocate of solar, wind, and micro-nuclear for altruistic and Nat'l security reasons. There's nothing wrong with "progress". I just don't want to be forced into someone's idea of "progress" at the end of a gun. Don't get me wrong. I'm not saying that the free market is the solution, but IMO it offers the best opportunity to find a solution, not to achieve an ideal world of fantasy.

For example. we like solar but we don't like the problem of recycling them. Same goes for some battery tech. It's like the industry just puts its head in the sand, hoping that somewhere down the line, someone will figure out an economic way to recycle them. I have an issue with that because the last thing I want to see is some kid in China squatting over a makeshift smelter trying to leach rare earth elements out of some solar cells or circuit board.

There's no such thing as a free lunch.

@ Chris, thats a different

@ Chris, thats a different subject, subsidies have nothing to do with recyclability and i agree, all items should be able to be recycled, that is yet more progress we have to make.

Guns are not the issue, but the free market is not a religion that rewards the pious and punishes the sinners

Log in or create an account to post a comment.

Sign up Log in