Image Credit: Appraisal Institute (all images)

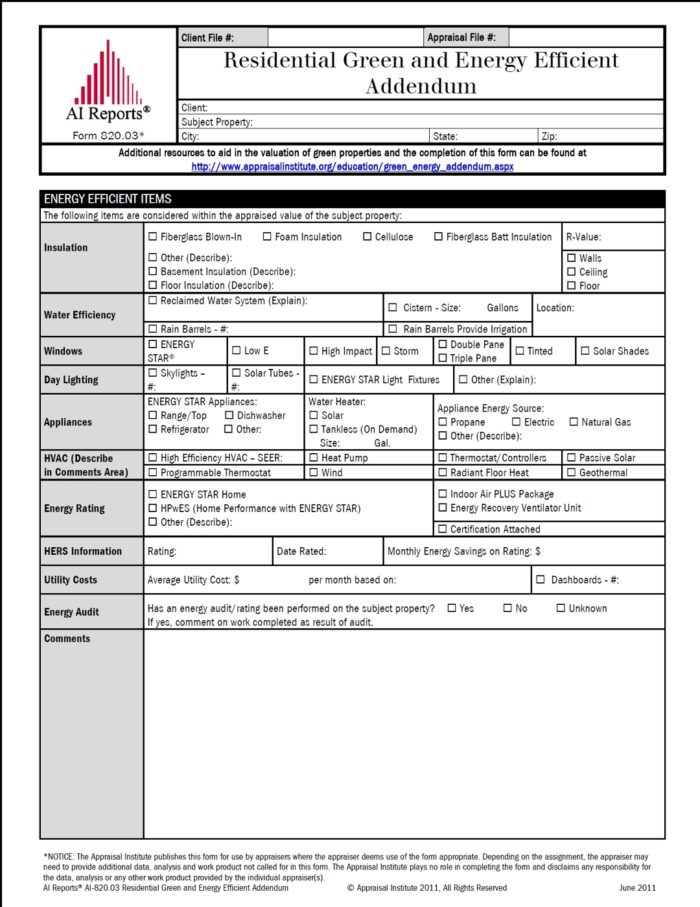

Image Credit: Appraisal Institute (all images) Page 2 of Form 820.03, which is an optional addendum to Fannie Mae Form 1004, the appraisal industry’s most widely used form for mortgage lending purposes. The form allows appraisers to identify federal, state, and local incentives that were applied to the purchase of products that increase the property’s energy efficiency.

To say this is an era of heightened scrutiny of the appraisal industry is an understatement. Flat-lining home sales and prices have sellers – including homebuilders – sharply focused on the fairness of lender valuations, especially those in markets afflicted by foreclosures.

Another factor complicating appraisals: the green home, whose energy-saving features have so far been ignored in most valuations. That’s partly because green homes are still relatively new to the market and suitable comparables difficult to find. It’s also because the market value of green home features has been poorly understood by many appraisers and lenders.

But at least one industry group is trying to address the issue. Last month, the Appraisal Institute, an industry group based in Chicago, issued an appraisal form designed to help appraisers analyze green features in a consistent and fair way. The new document, officially labeled Form 820.03, was presented as an addendum to Fannie Mae Form 1004, a widely used valuation form completed by appraisers and accepted by mortgage guarantors Fannie Mae and Freddie Mac, and the Federal Housing Administration.

If it’s filled out, will lenders use it?

It’s a reasonable first step, since it will help bring green features to the attention of lenders. Whether lenders will choose to factor those green features into their valuations is another matter. A look at the three-page form indicates they should consider green features if their valuations are going to be fair, since the items listed on the addendum focus almost entirely on features that can reduce energy costs when the home is occupied and fully operational.

Items eligible for consideration within the appraised value of a property include insulation systems (their type, location, and R-value); water efficiency systems; daylighting features; appliance performance ratings; average utility costs; energy audit data; photovoltaic systems; LEED for Homes and National Green Building Standard certifications and scores; and government incentives that may have been applied to the purchase or installation of the property’s energy efficiency systems.

It will take time for the green-home addendum to catch on, although pressure from homebuilders and other home sellers who have invested in energy efficiency measures – a steadily growing group – are likely to keep the pressure on until they’re satisfied the improvements are fairly factored into valuations.

“We hope this new form will be a big step toward establishing more accurate home valuations that recognize all of the key features of a home,” Kevin Morrow, senior program manager of green building programs at the National Association of Home Builders, said in a press release touting the addendum. “Green homes can offer significant cost savings to home owners over a comparable home built to code, so we are pleased that this new form will finally provide a vehicle to demonstrate some of these key differentiators.”

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

5 Comments

Realtors against energy ratings

When they are not under pressure from lenders, I believe most appraisers are happy to provide accurate valuations based on data, and I'm sure they will embrace this new set of valuation tools. What often escapes scrutiny is the opposition of real estate agents and brokers to home energy ratings and audits. In their view, and rightly so, when we start rating homes for energy efficiency, health and durability, many homes will come up short. And this will limit the ability of agents to sell these houses and earn their commissions. Many Realtor groups have actively campaigned against the adoption of home energy ratings and audits for this reason.

You're right, Kathy

That's also why the National Association of Realtors is (publicly) neutral on the SAVE Act. Privately, I've heard they are very much against it.

I haven't yet spoken to EcoBroker about it, but my guess is their stance is different.

Add pre 1978 homes to the list

It may not be a big deal but here in MN in some jurisdictions, any home built before 1978 will require the contractor to have a Lead Certificate to get a building permit. It will be interesting to see if there is a valuation difference between pre and post 1978 homes with the new lead requirements taking effect.

It's is a start

Also the Apprasial Institute has published in July a instructional guide for their appraisers on the "how to" to a green appraisal. The bigger problems are that most appraisers aren't members of the AI, and most members of the AI haven't taken the coarses they offer on appraising energy efficient homes. This part of the the energy efficient home building process is perhaps the biggest obstacle for most people trying to get financing for their energy efficient home. I just recently went through this process and not one appraiser had even heard of LEED. Be prepared to do alot of education of your appraiser. I personnally had to pay for a copy of AI's "how to" guide to my appraiser's. The lead person for AI that is leading the change is Sandra Adomatis, a resource well worth looking up. Also be aware that it is your right as the person paying for the appraisal that you can query the qualifications of your appraiser and if you feel they are unqualified to do the job, you can request another one. I learned this very painfully, and had to vigorously defend this position with my lender which successfully got us appraised by a member of AI...it cost more but well worth it

Mandatory home energy ratings

I'm not a realtor, but I am generally against mandatory home energy ratings for resale homes. For new homes, it's OK.

Here's the scenario:

1. You need to sell your home quickly because you have lost your job.

2. Your house was built in 1928 and has terrible energy efficiency and needs a total remodel, if not a complete scrape off.

3. Therefore, the value of your home could be just the value of the land.

4. As the seller, the up front cost of an audit would be onerous and useless.

Log in or create an account to post a comment.

Sign up Log in